Key words :

future energies,

nuclear

,politics

,climate change committee

,power generation

,drax

,powerfuel

,sizewell

The wider lessons from nuclear power cost inflation

26 Oct, 2009 03:32 pm

The Guardian newspaper of Monday 19 October broke the story that the UK government is preparing to guarantee a minimum price for carbon dioxide emissions to encourage the development of nuclear power stations. Putting a high cost on greenhouse gas emissions from power stations will force up the wholesale price of electricity, ensuring a better financial return for nuclear power stations (and for renewables such as wind). The decision to create a floor price for carbon demonstrates that the full costs of nuclear technology are probably well above today's wholesale electricity prices. We may well need nuclear power but we are going to pay heavily for it. The government?s optimistic noises from 2006 to the middle of this year about the commercial viability of nuclear power have turned out to be wrong.

|

| World Nuclear Association. |

| Until this week, we thought that Sizewell B was likely to be the most expensive nuclear power station built in the UK. |

More generally, this note argues that the failure to incentivise nuclear construction in the current liberalised electricity regime may oblige the UK to introduce high guaranteed ‘feed-in’ payments for all low-carbon generators, including the very largest power stations. Guaranteed tariffs may be a more effective instrument for incentivising low carbon generation than the carbon dioxide price.

2006 government views on the costs of nuclear

In September 2006, David Kennedy, then a senior civil servant in the UK Department of Trade and Industry (now BIS) and currently the chief executive of the Climate Change Committee, submitted a paper to an academic journal on the economics of nuclear power.[1] The paper was published the following year. In the paper Dr Kennedy looked at the likely costs of building new nuclear plants in the UK. He then used these estimates to say what the wholesale price of power would need to be to encourage the building of new nuclear power stations.

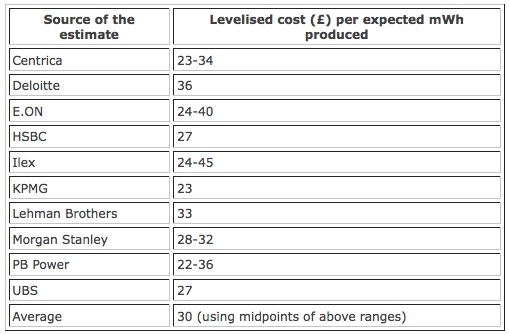

Table 3 of his robust and cautious paper contained 10 estimates from independent external sources of what is called the ‘levelised’ cost of electricity from new nuclear. ‘Levelised’ figures spread the costs of a power station over its expected lifetime generation of electricity and account for matters such as the deconstruction of the power station at the end of its life. An interest rate is applied so that money spent now is given a higher weight than the money expended in sixty years’ time.

The ten estimates quoted by Kennedy were as follows:

|

The average was £30 per megawatt hour (mWh). This is equivalent to 3p per kilowatt hour. For comparison, current UK retail prices for electricity are about 13p a kilowatt hour.

Dr Kennedy’s paper went on to provide a more conservative figure that UK policymakers might use. He assumed a cost of £37.50 per kilowatt hour. The analysis also suggested a figure of £43.70 as an ‘extreme’ high case.[2] The wholesale price of electricity, at least as shown in medium-term contracts to buy and sell power, varies between about £50 per mWh and about £60.[3] Ofgem’s recent energy market scenario report also suggests a figure of about £60 for late in the coming decade when the first new nuclear plants might be starting to generate. So readers of Dr Kennedy’s paper would have assumed that nuclear power is profitable at current market prices and at projected future levels. Indeed, government policy-making from 2006 to 2009 has explicitly assumed that nuclear is ‘cost-competitive’ with other forms of generation such as gas and coal.

The views of the Committee on Climate Change, December 2008

By late 2008, the Committee on Climate Change (CCC) had a very slightly different view:

Current estimates of the likely cost of generating electricity from new nuclear are in the range 4-5p/kWh (£40-50 per mWh). These cost estimates are higher than typically produced two to three years ago, as a result of the significant increases in steel and other component prices, and of significant supply bottlenecks which have emerged as demand for new nuclear power station construction has come up against a limited capacity supply industry.

But fossil fuel price increases over that period have produced an even greater increase in the cost of fossil fuel based electricity, and the relative cost position of nuclear has therefore improved.Less than a year ago, the CCC was saying that nuclear was the lowest cost generating plant for power generation even though its estimates were higher than Kennedy’s figure of two years earlier. ‘4-5p’ per kilowatt hour for nuclear compared favourably to more than 6p for gas generation and more than 7p for coal. Its view was unambiguous:

Nuclear power is competitive with both coal and gas-fired generation in the central fossil fuel price scenario even without a carbon price.The Guardian’s news story

In October 2009, if the Guardian reports are accurate, the government is admitting that nuclear is not able to compete with fossil fuels except with protection from a high carbon price. The newspaper mentions a figure of €30 a tonne, compared to today’s price of CO2 emissions permits in Europe of about €13 a tonne. This levy will be added to the cost of using coal as a fuel for the power station and the effect will be to increase wholesale prices.[4] A €30 price for a tonne of CO2 will add about £20 to the cost of producing a mWh of coal-generated electricity.

During the course of 2009 the implied cost of nuclear power has risen from being no worse than competitive with gas and coal (at a zero carbon price) to being €30 (£27) per mWh more expensive.

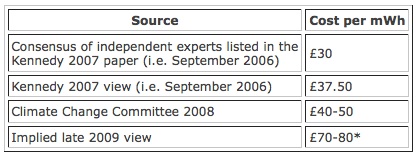

Put at its simplest, the progression in nuclear cost estimates is therefore as follows:

|

* £20 for the carbon permits to produce a mWh of coal-fired electricity added to the current wholesale price of £50 or future prices of £60 per mWh. Assumes that that the €30 a tonne figure suggested by the Guardian is the level required to cover the ‘levelised’ costs of nuclear power per mWh.

For reference purposes, it may be helpful to know that the last nuclear power station built in Britain, Sizewell B, has levelised costs in today’s money of about £60 a mWh, or somewhat less than the apparent current projections of nuclear costs but higher than any of the government figures from the 2006-8 period.

Why is this important?

Nuclear power has gone up in price, probably by a factor of between two and three above what was expected even a few years ago. This is no surprise and even this blog predicted such figures early this year (see here and here). The continued problems at the new Finnish nuclear power station raise the strong suspicion that cost estimates will rise further in the future.

More generally, the Guardian report buttresses the case of those who say that the UK needs a guaranteed floor on the carbon price urgently. Today’s gas prices are very low by recent standards and depressed world economic growth may cause this to continue. The rational investor is therefore looking to build new combined cycle gas turbine power stations to profit from these low fuel prices. This runs the risk of either locking the UK into carbon-emitting power generation and/or shortages of power if the current glut of gas reverses unpredictably or if emissions targets oblige the generators to curtail production. But, as it stands today, the generators are queuing up to build unabated gas power stations. At today’s gas and carbon prices not only nuclear power but coal with carbon capture is looking very expensive.

The EU’s decision last week to back Powerfuel’s Hatfield coal gasification (IGCC) plant is welcome, but the project may only make financial sense with carbon prices at least as high as needed for nuclear power. Powerfuel’s proposed technology is still largely unproven at the scale envisaged and it may well turn out to be far more expensive than expected. There are many sceptics out there around the world saying that IGCC with capture will be even more expensive than nuclear. And offshore wind, today buttressed by a temporary increase in renewable subsidies in the UK, will need similar long-term incentives.

Are there any solutions?

My strong sense is that the woefully slow progress in developing new UK sources of low-carbon electricity might possibly be remedied by agreement between the main UK political parties on a high and semi-permanent carbon tax, probably of at least £40 a tonne. This may imply an increase in electricity costs of about 3 pence per kilowatt hour, a painful jump on already historically high levels.

Or – and this runs completely against the spirit of electricity market liberalization over the last twenty years – it may be simpler to copy the micro-generation feed-in tariffs scheme and offer a stable and guaranteed price for low-carbon electricity sources constructed in the next fifteen years, perhaps with higher prices for the first 10, 20, and 30 gigawatts of capacity constructed. The early rate might be £80 per mWh for nuclear, £90 for coal with capture, £70 for onshore wind, and £100 for offshore. The effect of this measure will be to unwind the working of the free(ish) markets in electricity generation and retailing. Few people may yet be willing to contemplate such a massive change, but even enthusiasts for liberalised energy markets must surely admit that the inability to incentivise the construction of nuclear, coal with CCS or even wind under the current system is indicative of a market failure of dangerous and unprecedented proportions.

Footnotes

[1] David Kennedy, ‘New nuclear power generation in the UK: Cost benefit analysis’, Energy Policy, 35.7 (2007), 3701-16.

[2] Kennedy 2007: 3709.

[3] Drax power station, by far the biggest in the UK, records in its latest financial statement of August 2009 that the average price it has sold electricity in the forward market for 2011 is £60.30 per mWh.

[4] This requires the assumption that coal power stations are pressed into service last: after gas and renewable (i.e. in economist’s language, coal stations are the ‘marginal’ producers).

Originally published at Carbon Commentary

Key words :

future energies,

nuclear

,politics

,climate change committee

,power generation

,drax

,powerfuel

,sizewell

-

12/12/12

“Peak Oil” is Nonsense… Because There’s Enough Gas to Last 250 Years.

-

05/09/12

Threat of Population Surge to "10 Billion" Espoused in London Theatre.

-

05/09/12

Current Commentary: Energy from Nuclear Fusion – Realities, Prospects and Fantasies?

-

04/05/12

The Oil Industry's Deceitful Promise of American Energy Independence

-

14/02/12

Shaky Foundations for Offshore Wind Farms

Don't you mean ?37.50 per megawatt hour??

The article points out that wind, nuclear, and CCS coal all cost about the same. Costs for all of them have risen due to higher demand for construction materials, mainly in Asia. Solar isn't mentioned, but costs several times more.

Furthermore, most of the world's electricity comes from plants built decades ago; not only were construction costs lower then, but the initial costs mainly have been paid off. Any new electricity will cost much more, even if it comes from fossil fuels.

Is it necessary always to bash nuclear energy? One could as well conclude that all energy forms are unaffordable. A better title for this article would be "The wider lessons from new power cost inflation."